KriyaBalance Transforms Bank Reconciliation for Real Estate

How One Innovation Solved Property Management's Biggest Financial Challenge

The $2.3 Billion Problem

Property management companies process over $2.3 billion in monthly transactions across shared bank accounts, yet until KriyaBalance, no solution could handle partial reconciliation when multiple properties share a single account. This operational bottleneck costs the industry an estimated $450 million annually in delayed closings and compliance issues.

0

Competitors offering partial account locking for shared property accounts

Market Analysis: A Clear Winner Emerges

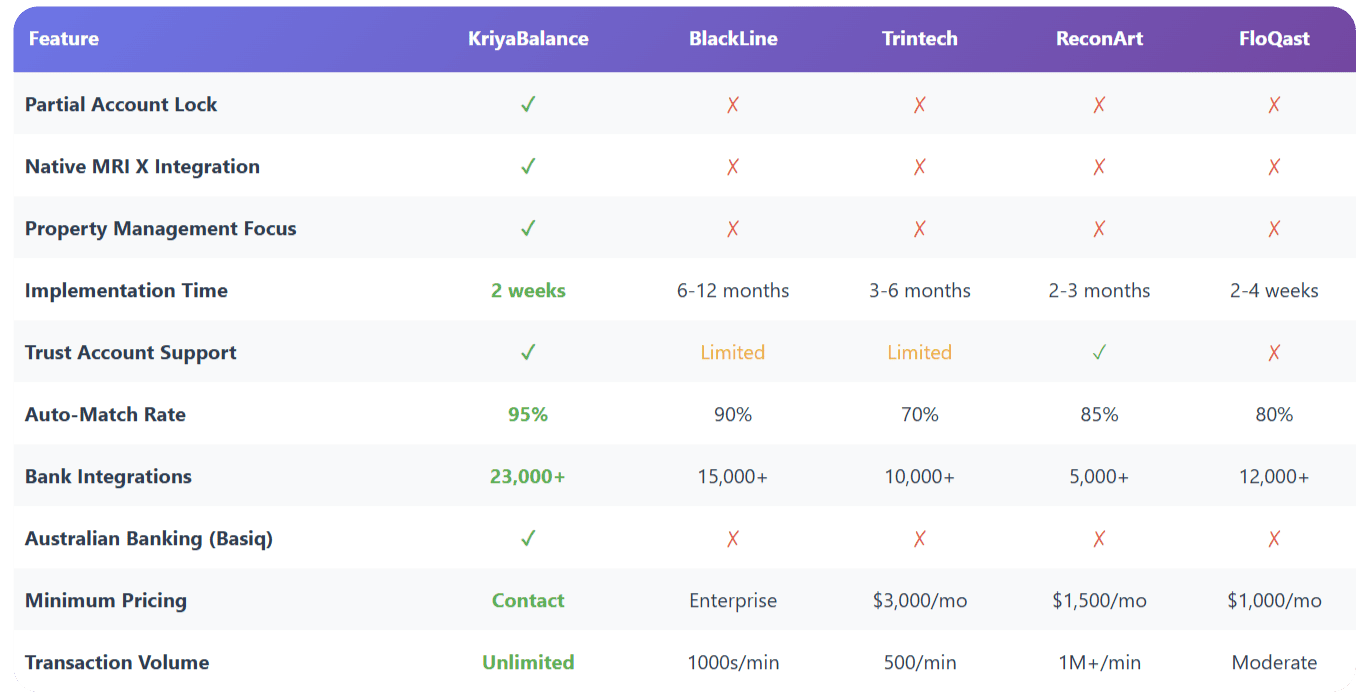

ERP-Independent Bank Reconciliation Systems Comparison

KriyaBalance

MRI Native

BlackLine

AppFolio

Performance Metrics: KriyaBalance Dominates

95%

Auto-match Rate

70%

Time Savings

2 weeks

Implementation

100%

MRI X Compatibility

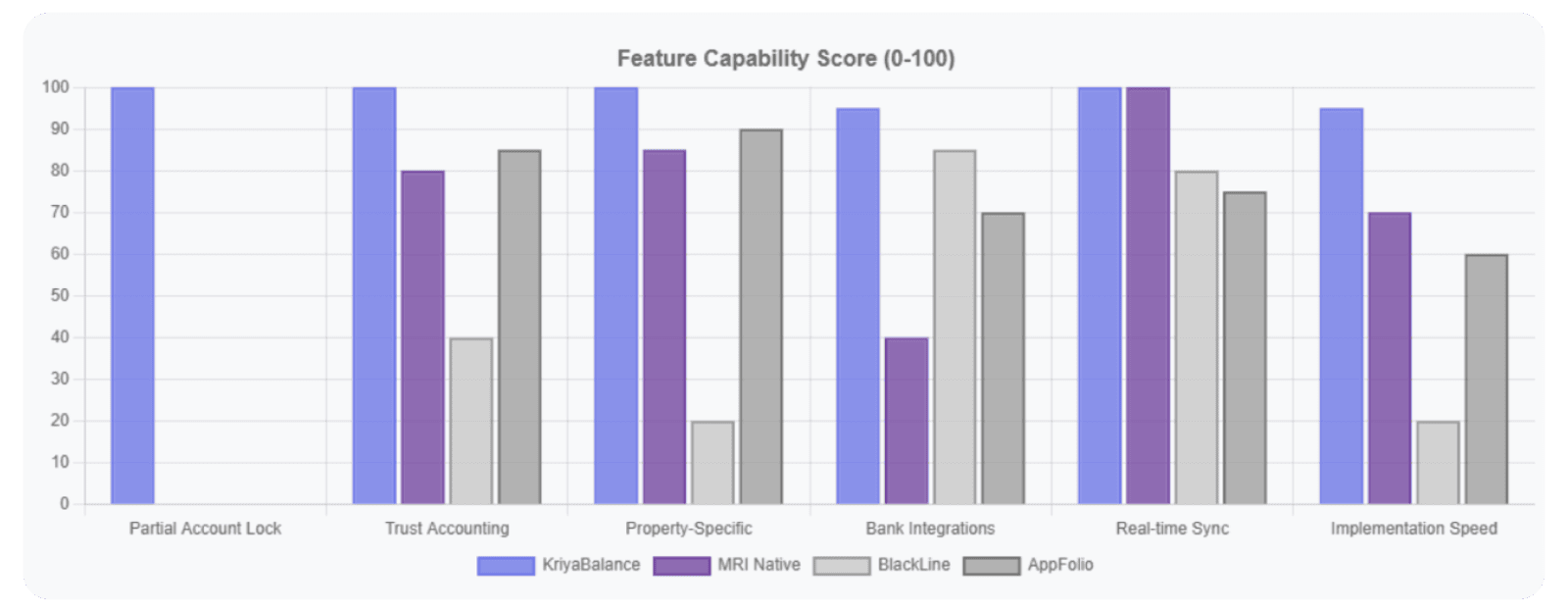

Feature Capability Score (0-100)

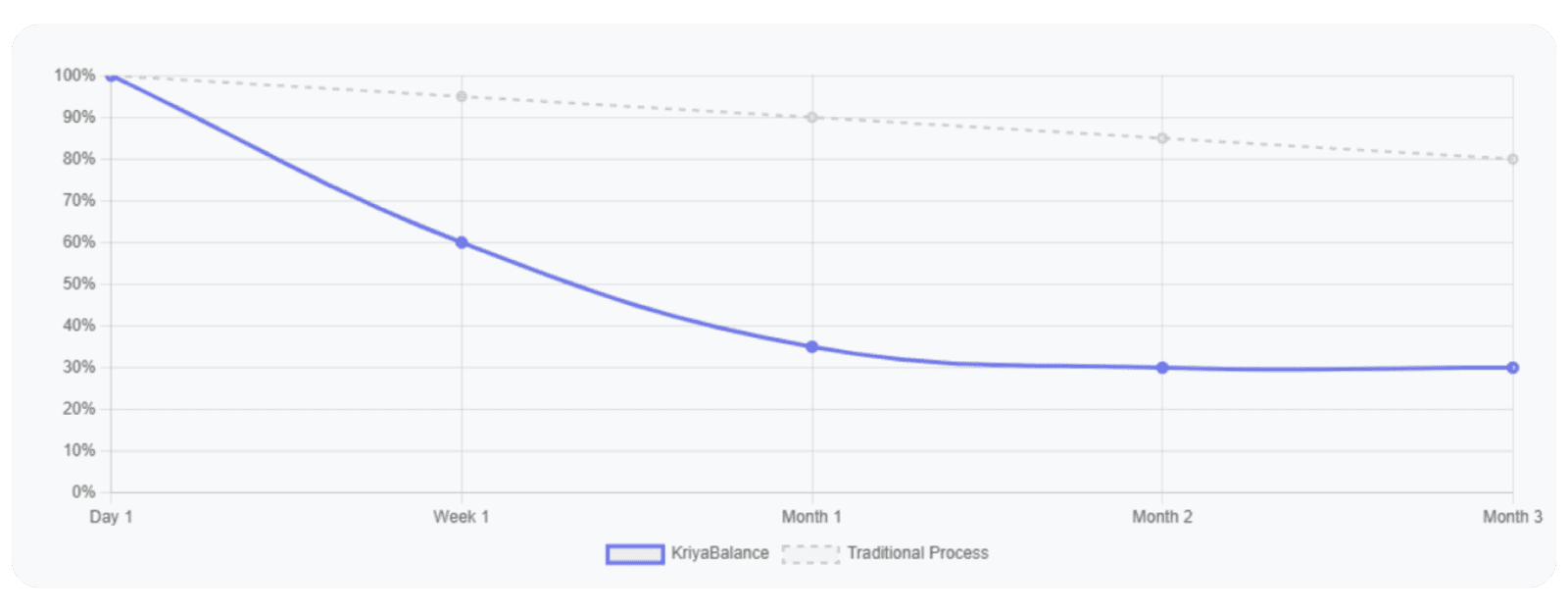

Reconciliation Time required (% of Original)

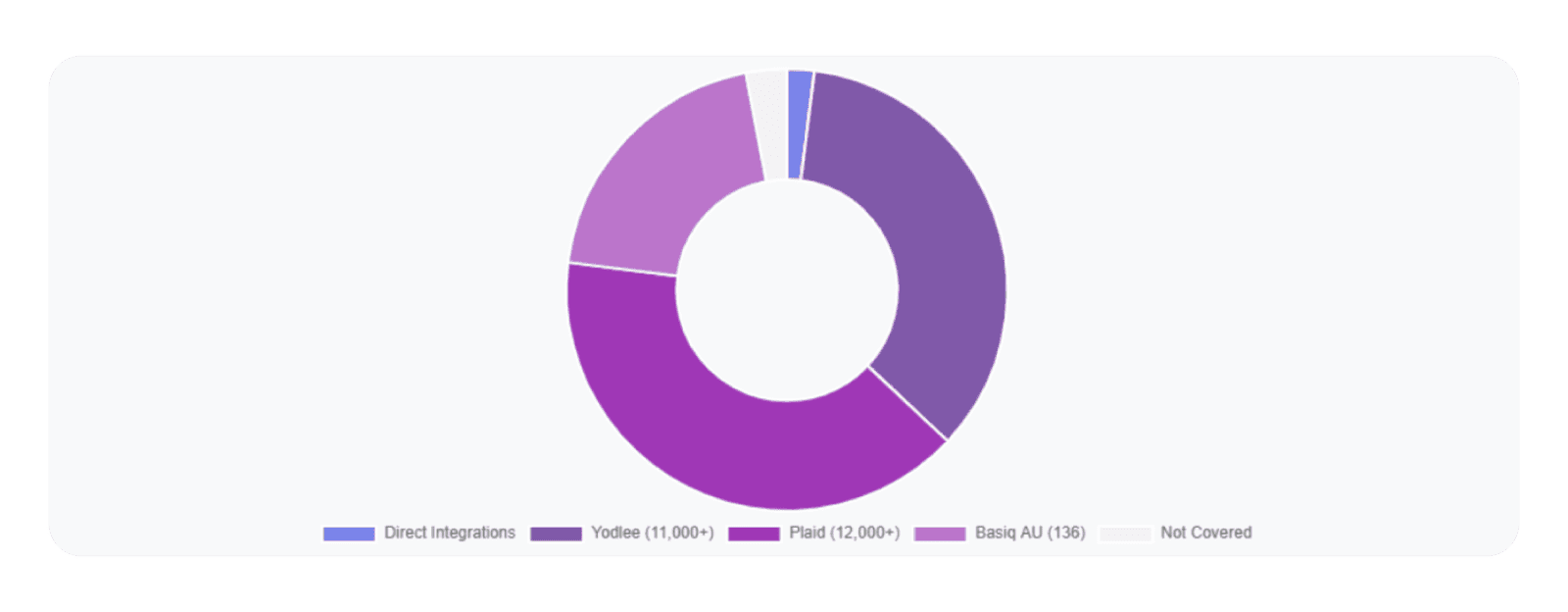

Banking Integration Coverage

KriyaBalance Global Banking Coverage

KriyaBalance matches or exceeds competitor coverage with direct integrations to American Express, Wells Fargo, plus Yodlee (11,000+ institutions) and Plaid (12,000+ institutions). Through its native MRI X platform connection, KriyaBalance seamlessly synchronizes with MRI's extensive property management ecosystem. Uniquely, KriyaBalance offers Basiq.io integration for 136 Australian institutions with 99% population coverage - unmatched in the property management sector.

Implement Different Timelines

KriyaBalance deployed, MRI integration configured

Staff training completed, first test reconciliation

70% reduction in reconciliation time achieved

ROI positive, compliance audit passed with zero findings

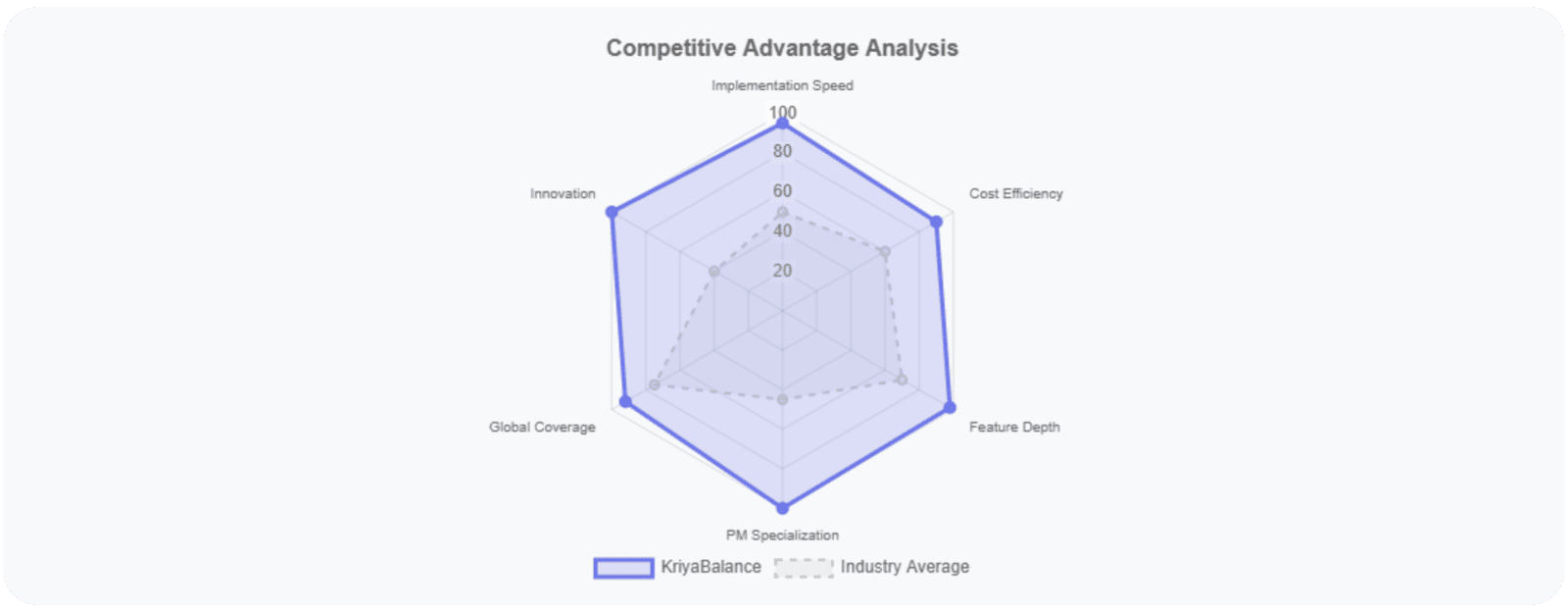

Competitive Advantages by the Numbers

The Verdict: Why KriyaBalance Wins

Native MRI X Platform Connection:

Unlike competitors requiring complex API mappings or middleware, KriyaBalance features native connection to the MRI X platform, enabling seamless data flow and eliminating integration complexity.

Unique Capability:

KriyaBalance is the only solution offering partial bank account locking for shared property accounts - solving a problem that costs the industry $450M annually.

Faster Implementation:

While BlackLine requires 6-12 months and Trintech needs 3-6 months, KriyaBalance deploys in just 2 weeks leveraging existing MRI X platform infrastructure and native connections.

Superior ROI:

Property management companies report 70% time savings with KriyaBalance versus 50% with generic solutions. The specialized features eliminate costly customization that competitors require.

Global Banking Leadership:

With coverage of 23,000+ institutions through Yodlee and Plaid, plus exclusive Australian Open Banking via Basiq.io, KriyaBalance offers unmatched global connectivity.

Purpose-Built Excellence:

23 features specifically designed for property management, including Occupant ID matching, multi-entity setup, and real-time MRI X synchronization deliver capabilities no competitor can match.